The New York Times recently asked ten retail-level buyers of Chinese stocks why they were in the market. The answers constitute a remarkable piece of financial journalism. They answers seem to be all negative. Or as the Times put it, these buyers “are speculating, looking for short-term gains, with a great degree of uneasiness” (October 21, 2024).

A Mr. and Mrs. An have $300,000 in the markets and “reasoned that they might lose money either in the stock market or by doing nothing if inflation eroded the value of their savings. But what if they get lucky?” This was the brightest outlook in the piece.

A Mr. Wang, who has put the equivalent of $150,000 in stocks, had the gloomiest outlook: markets are “even worse than a casino because a casino has rules, while our ‘casino’ has none. Furthermore, the ‘owner’ of this casino can step in and play, and they can see our cards.”

A Mr. Xie, an asset manager no less, thinks that the current rally “will be short-lived. ‘The financial markets cannot fix the fundamental and long-term issues China faces.’ ”

A Mr. Cheng has lost $500,000 on stocks and “found that the country’s business environment turned increasingly hostile to the private sector under Xi Jinping, China’s leader. ‘I’ve never seen anyone play such a good hand so terribly.’ ” Further, “I’m approaching this with the mind-set of a spectator. I’ve paid for the ticket, I might as well watch this tragic movie all the way through.”

Two out of four

The famous stock operator Edwin Lefèvre once noted, “The speculator’s deadly enemies are: Ignorance, greed, fear and hope.” The Times has uncovered two out of four here: ignorance and fear. In our American stock market market media, we are more used to a drumbeat of greed and hope.

We are also more used to individuals “talking their book,” expounding on the wisdom of their investment choices and urging others to get on board.

The Chinese, however, have every reason to fear their stock markets.

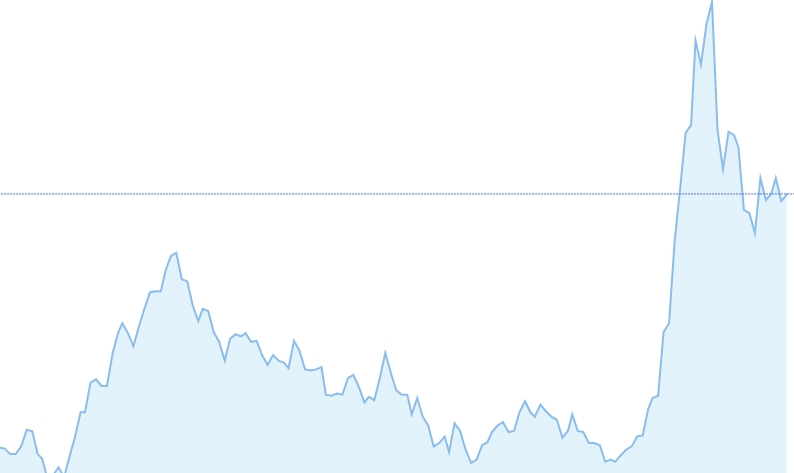

● In January 2024, CNN reported that “Chinese stocks have lost $6 trillion in 3 years.”

● Also in January, Newsweek reported that “China’s Stock Market Is in Free Fall.”

● In February, CNN reported that “Angry Chinese take to US Embassy’s social media account to vent about plunging stock market.”

● But by the next day, we were learning that the government “is pumping money into stocks and markets are loving it.”

● By May 3, reports stated that “China’s stock market has staged a big rebound that’s poised to push on.”

Before it slumped and kept slumping.

Then came that end-of-September government stimulus package and the question became “China’s Market Frenzy: Will the Euphoria Last or Fade Fast?”

Oh, the excitement!

“China’s stock market is undergoing a resurgence of historic magnitude, driven by an unprecedented series of policy shifts that have injected new vitality into an economy that had long seemed stagnant,” said The Diplomat’s Lizzi Lee. “In the final days of September 2024, a confluence of monetary easing, regulatory adjustments, and fiscal stimulus orchestrated by Beijing unleashed a flood of capital, restoring approximately $1.8 trillion in value across its major stock exchanges.”

Magic

The magic of stimulus, such as it is, had not reached the hearts of the individual speculators interviewed by the Times by the time the story was filed. Unless, that is, they were playing dumb for the reporter, to whom it had not occurred that these folks might be quietly attempting to front-run the next stimulus measure.

A stimulus arrived the same day as the story: “China cut benchmark lending rates as anticipated at the monthly fixing on Monday, following reductions to other policy rates last month as part of a package of stimulus measures to revive the economy. The one-year loan prime rate (LPR) was lowered by 25 basis points to 3.10% from 3.35%, while the five-year LPR was cut by the same margin to 3.6% from 3.85% previously.”

That’s a nice stimulus booster shot but not terribly impressive in its results: by week’s end, it had yielded a 3.5% gain for the week on the Shanghai Composite Index. A new round of doldrums, or worse, is on the horizon.

And for the speculators talking to the Times, hoping for a short-term score, everything depends on market timing, when to buy and when to sell. This is notoriously difficult. As our famous stock operator said, “The big money in booms is always made first by the public—on paper. And it remains on paper.”

Of course, more stimulus will be dreamed up and produce more of the inflation that Mr. and Mrs. An so fear. For instance: “China should issue 2 trillion yuan ($281 billion) of special government bonds to help create a market stabilization fund, according to a top government-linked think tank.”

How’s that for good thinking? A kind of Chinese Plunge Protection Team. But if history is an indicator, it’s going to need $6 trillion to start, isn’t it?

Some say that China’s stock market is uninvestable. They are correct. □

James Roth works for a major defense contractor in Virginia.

Also see:

StopTheChinazis.org: “China’s Bold Stimulus Package Backs Losers, Reinforces Failure, Extends Losses”