Since the coming of Xi Jinping to power in 2012 and his imposition of ever more controls, including a brutal years-long COVID containment policy, the golden future of the Chinese economy has come into question. The Chinese Communist Party government has made the business environment even more uncertain by targeting disfavored persons and increasing restrictions on foreign companies operating in China.

And the marked increase in aggression toward other countries has created a wave of negative press, causing countries and businesses to anticipate further decoupling from China.

Tumbling market

The property market continues to tumble. This market represents a large share of personal equity; for many Chinese families, real estate is a favored method of saving. Many building projects have run out of funds while still under construction as others, completed, stand empty.

China is trying to use monetary stimulus to juice its economy.

The New York Times reports that with its latest stimulus package, China has pumped billions of dollars into the Chinese market by relaxing lending restrictions for banks. Banks are allowed to lend against smaller reserves. They are also expected to take a small haircut on mortgages, leaving more cash in homeowners’ pockets or perhaps reducing the number of defaults.

News of the stimulus has led to a surge in stock prices. The CSI 300 climbed to over 3700, a more than 500-point gain, bringing it to where it was last September but still far below where it was three years ago: over 5000. (See this chart at Yahoo! Finance.) The CSI 300 is thought to be comparable to the S&P 500.

Can this stimulus overcome the fundamental problems caused by Xi and the CCP?

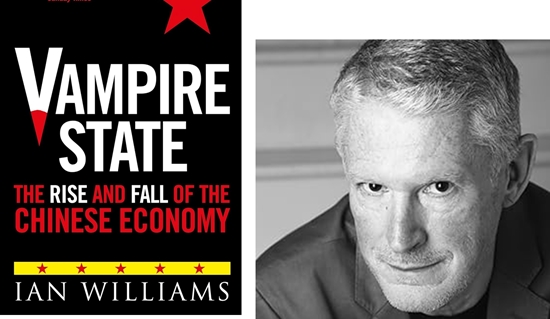

Vampire State

Ian Williams (shown above) explores these happenings in his forthcoming book Vampire State: The Rise and Fall of the Chinese Economy. At CapX, he writes that his book tries “to understand the predatory and at times bizarre nature of [China’s] economy—and the mind-bending experience of doing business with it” (“Xi Jinping’s Coercion Is Destroying His Own Economy,” September 16, 2024).

Rules and agreements mean little, markets are distorted, statistics fabricated, foreign industrial secrets and technology systematically stolen, while entrepreneurs who fall out of favour with the CCP routinely disappear.

The model that has powered four decades of breakneck economic growth was reliant on cheap exports and wasteful state-led investment in property and infrastructure. It is no longer sustainable. It has led to soaring debt and diminishing returns, with China littered with ghost cities, containing 60 to 100 million empty or incomplete homes, while companies accounting for 40% of China’s home sales have defaulted. It is widely agreed that China needs to rebalance its economy, that consumers need to spend more, since private consumption accounts for just 39% of the economy—extremely low by world standards (the figure in the US is 68%). But there is no consumer confidence, with 80% of family wealth tied up in property and no meaningful social safety net.

Companies are taking a harder look at whether they should invest in China, and companies that have been operating in China are pulling out. Williams writes that “under Xi, the environment has become increasingly hostile. Last year, direct foreign investment into China fell to a 23-year low.”

Meanwhile, China may face even greater sanctions by the West as a result of its partnership with Russia. Shannon Brandao argues that China’s production of drones counts as “material support” for Putin’s war against Ukraine; such support “is the red line that Beijing must not cross if it wants to avoid similar economic sanctions that have been imposed on Russia by Europe and the United States.”

The resulting isolation of China would reduce its long-term ability to use its economy as a lever to extract concessions from other governments. Its economic decline would also mean fewer resources for the Chinese armed forces.

But…

But such circumstances would also reduce the opportunity cost for the CCP to be aggressive militarily, particularly toward Taiwan and other neighbors weaker than China. And may also lead to more repression within China as the government further grasps for control of resources.

So although the economic decline of China may be good, overall, for the rest of the world, keeping China in the game rather than totally excluding it from the world market encourages it to play by international rules. It is in everybody’s interest to avoid “kinetic” conflict, that is, a physical war.